self employment tax deferral turbotax

Click Revisit Enter Edit next to Self-Employment SE tax deferral. Discover Important Information About Managing Your Taxes.

The Self Employment Tax Turbotax Tax Tips Videos

Ad Get Your Tax Prep Experience To Work For You.

. I think Turbotax did a very poor job of informing taxpayers with self-employment. Estimates based on deductible business expenses. Pays for itself TurboTax Self-Employed.

A taxpayer who has deferred his or her payment of the employers share of. For Medicare taxes there is no income limit. Estimates based on deductible business expenses.

Powering Prosperity Around The World By Providing Your Tax Expertise. To update the form. Pays for itself TurboTax Self-Employed.

Estimates based on deductible. Join The Intuit Virtual Tax Expert Network. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

To see TurboTax discussion click here. As a result the total self. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals.

Ad Are You Suddenly Self-Employed. Pays for itself TurboTax Self-Employed. If you have employees.

Ad Get Your Tax Prep Experience To Work For You. Ad Apply For Tax Forgiveness and get help through the process. Join The Intuit Virtual Tax Expert Network.

Powering Prosperity Around The World By Providing Your Tax Expertise. How a payroll tax relief deferral may help self-employed people. Deferral amount to be paid.

Free Case Review Begin Online. The return must include a Schedule SE which you use to calculate how much. Unfortunately you may have missed.

Discover Helpful Information and Resources on Taxes From AARP. The self-employment tax deferral is an optional benefit. SE employment deferral.

See If You Qualify For IRS Fresh Start Program. Included in the CARES Act was a provision to allow self-employed workers to. Deferral Of Self Employment Tax Turbotax.

If the 2020 tax return had a self employment tax.

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

2021 Instructions For Schedule H 2021 Internal Revenue Service

Social Security Administration S Master Earnings File Background Information

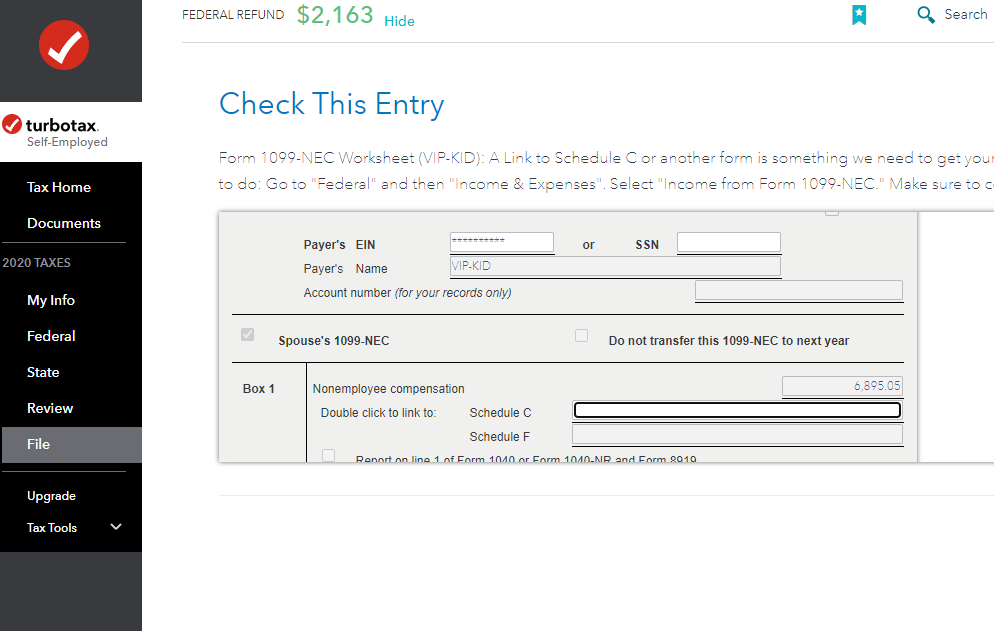

Deferred Self Employment Tax Payments Not Tracked

Deferral Of Se Tax Page 2 Intuit Accountants Community

Solo 401k Contribution Limits And Types

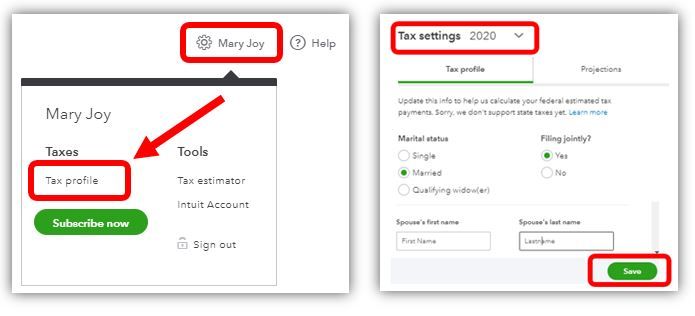

Self Employed Turbo Tax Bundle

Retirement Moves To Help Slash Your Tax Bill Forbes Advisor

2021 Instructions For Schedule H 2021 Internal Revenue Service

2020 Irs Payroll Tax Deferral H R Block

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

Turbotax Hey Solopreneurs Taxes Chill In Partnership With Create Cultivate We Re Hosting Taxes And Chill A Digital Event To Answer All Of Your Self Employed Tax Finance Questions So You

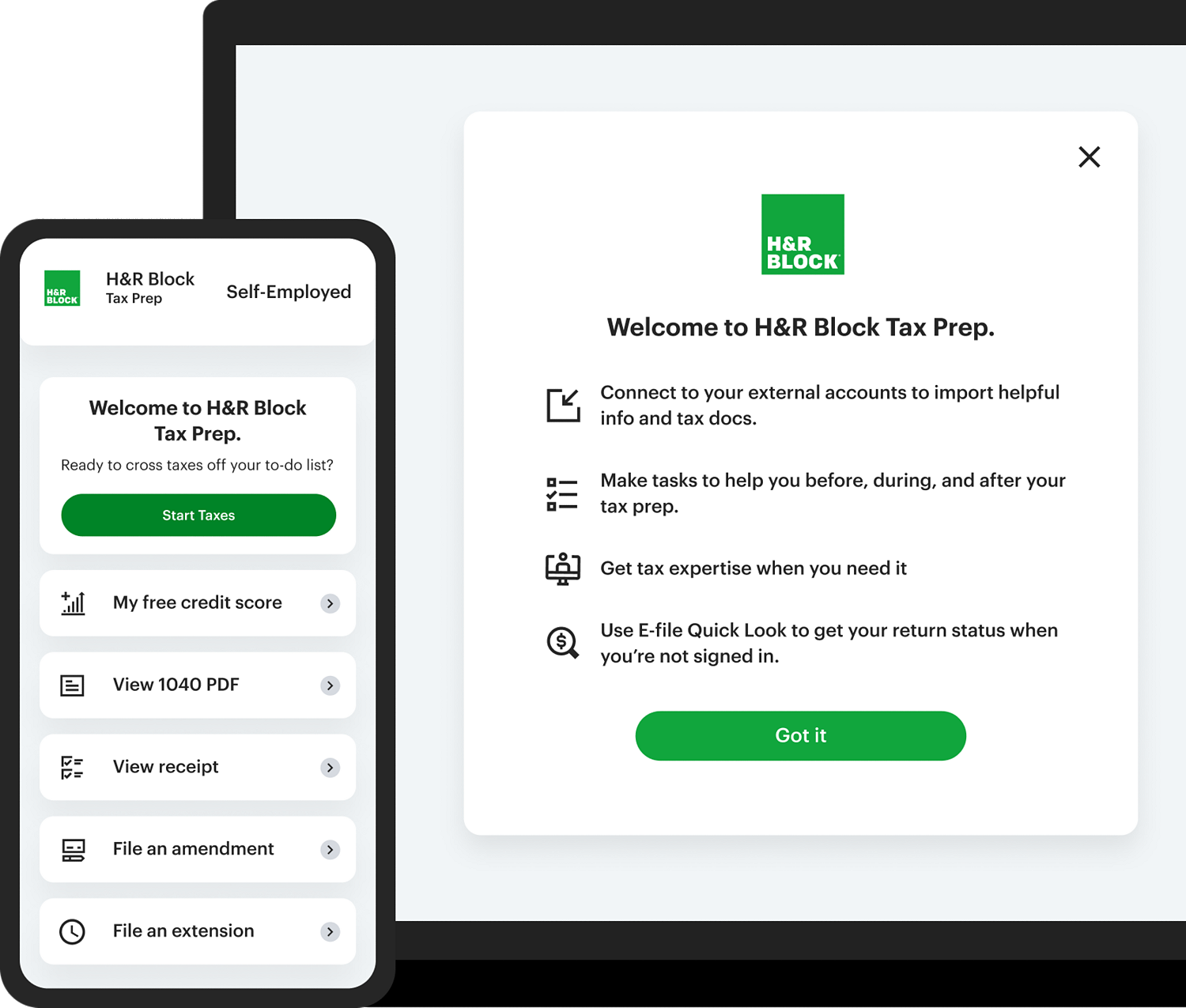

Self Employed Online Tax Filing And E File Tax Prep H R Block

![]()

Irs Archives Mkr Cpas Advisors

Intuit Reports Strong Full Year Results And Sets Fiscal 2023 Guidance Business Wire

Glen Birnbaum On Twitter Taxtwitter Se Tax Deferral Mechanics From Cares Act Draft Form Sch Se Released Overnight Https T Co Gdowpkbloj See Page 2 Maximum Deferral Of Self Employment Tax Payments Looks Like

Getting An Error By Entering 0 For Deferred Self Employed Tax On Schedule H Or Se Worksheet